How private equity firms can achieve compliance with the Sustainable Finance Disclosure Regulation

The Sustainable Finance Disclosure Regulation (SFDR) is a regulation determined by the European Union. The SFDR sets out mandatory sustainability disclosure requirements for a broad range of financial market participants, financial advisers and financial products such as investment funds.

The goal of the SFDR is to improve transparency in the market for sustainable investment products and to prevent greenwashing. By increasing transparency around sustainability claims made by financial market participants, the SFDR aims to direct capital towards more sustainable investments, products and businesses.

SFDR requirements contain a mixture of qualitative and quantitative information to be disclosed at the entity and product levels. All financial products should be categorized using one of the three SFDR classifications: Article 6, Article 8 or Article 9.

Why is ESG reporting important to financial health?

In addition to regulatory compliance, environmental, social and governance (ESG) reporting is critical to the financial health of a product, organization or business.

According to a survey conducted by Bain & Company in 2022, 93% of limited partners would walk away from an investment opportunity if it posed an ESG concern. Also, 50% of those surveyed cited better investment performance as a key reason to incorporate ESG.

What are the product-level requirements of the SFDR?

The SFDR features three different product categorizations:

How UL Solutions helps simplify SFDR compliance

SFDR Alignment Advisory Services:

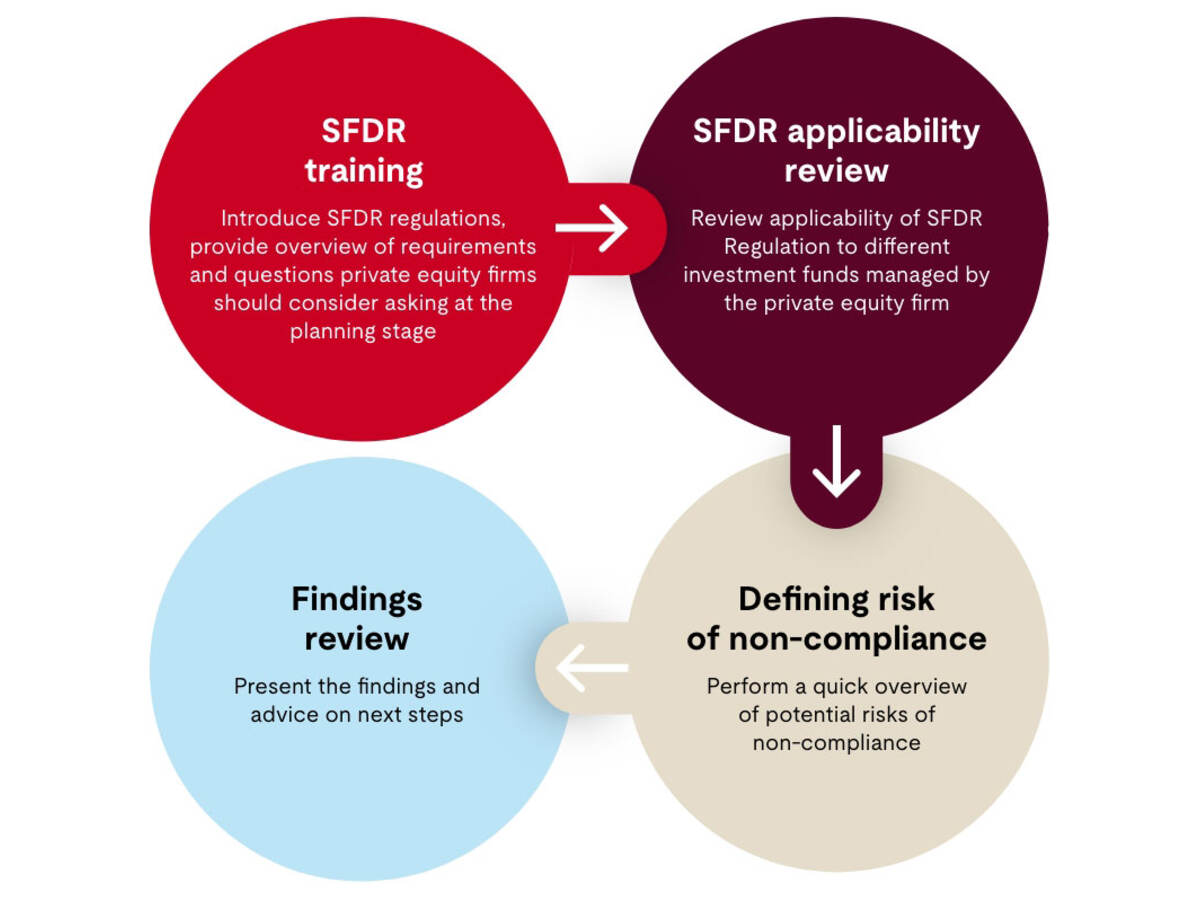

1. SFDR mobilization:

Improve your understanding about the SFDR regulation and raise awareness of how exposed your firm is to the regulatory risk.

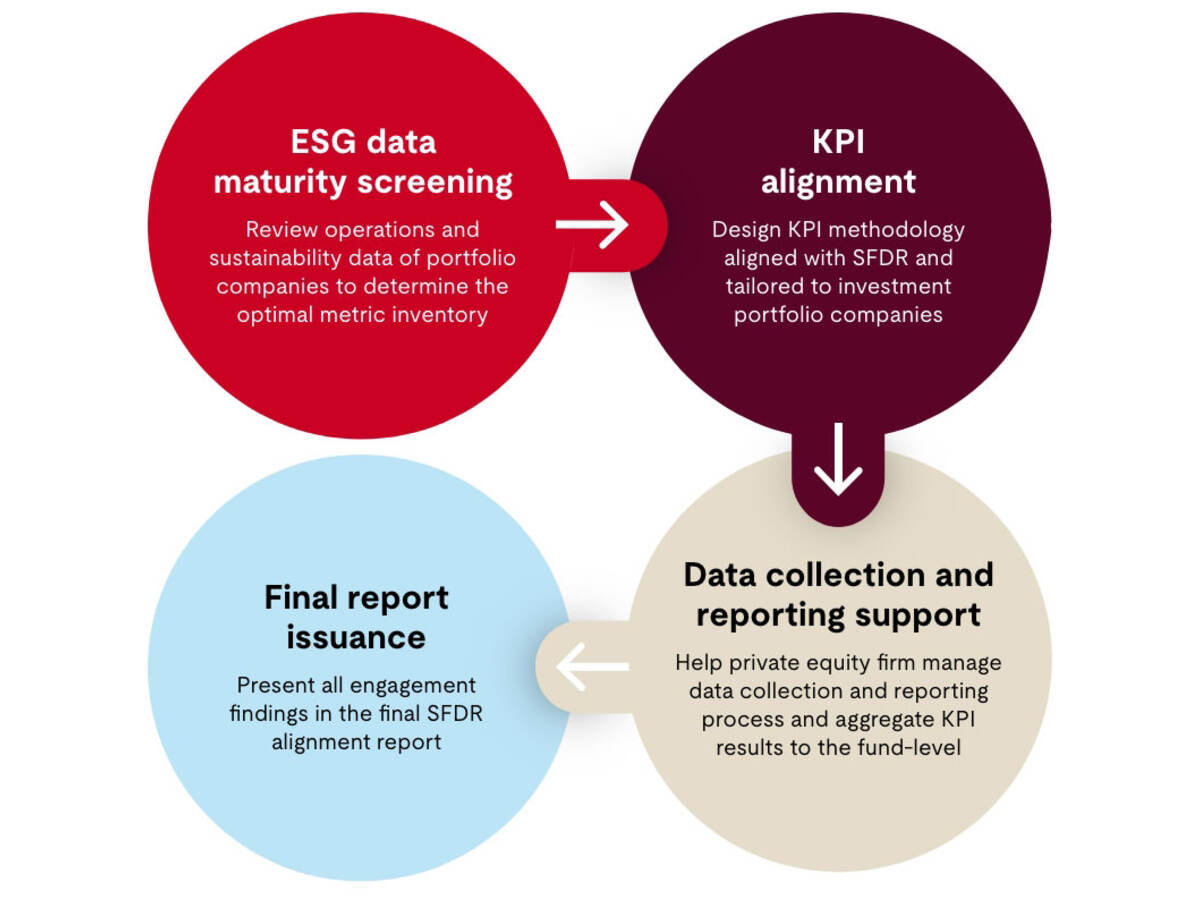

2. SFDR alignment

Help improve sustainability performance of your investment portfolio by aligning reporting with requirements of the SFDR regulation.

3. SFDR alignment (investee support):

Align ESG reporting of investment funds and their investee companies with requirements of the SFDR regulation using the agile investee support package

Outcomes of UL Solutions advisory services including:

-

Sustainability reporting is aligned with SFDR regulation.

-

SFDR metric inventory and methodology is tailored to portfolio-specific characteristics (based on investee operations and ESG data maturity).

-

Flexible work packages are available to pick and choose based on the nature and the scope of SFDR advisory required.

-

Complex regulation requirements and processes are broken down into simple language.

-

Solid foundation is created for measuring the sustainability risk of investment funds and informing further strategic decisions.

-

Sustainability expert support is provided during the phase of data collection and preparation for reporting.

UL Solutions approach to SFDR software services

ESG and Sustainability Management Software

Systemize your SFDR data collection, analysis and reporting with ESG and Sustainability Management Software by UL Solutions.

Get connected with our sales team

Thanks for your interest in our products and services. Let's collect some information so we can connect you with the right person.